PNC Virtual Wallet app for iPhone and iPad

Developer: PNC Bank, N.A.

First release : 05 Aug 2009

App size: 45.96 Mb

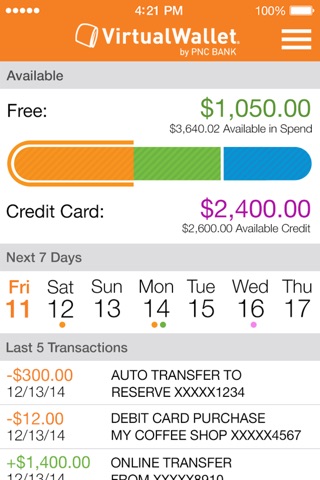

Virtual Wallet® is Checking & Savings. Together.

Manage your money the way you want.

VIRTUAL WALLET FEATURES:

Activity

View your Virtual Wallet pending and posted transactions, and categorize what you’ve spent to take advantage of Spending + Budgets.

Free Balance and Scheduled Out

Your Free Balance and Scheduled Out subtract known bills and expenses from your available Spend account balance. They’ll also show you potential Danger DaysSM, which is when your Spend account is at risk of being overdrawn.

Mobile Check Deposit (i)

Use the camera on your mobile device to quickly and easily deposit checks.

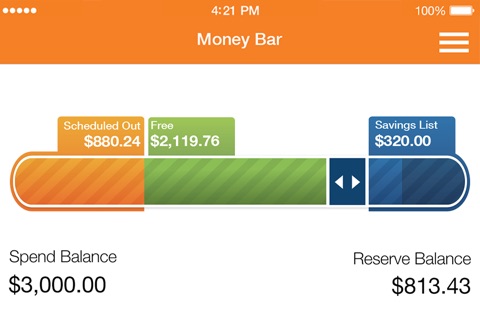

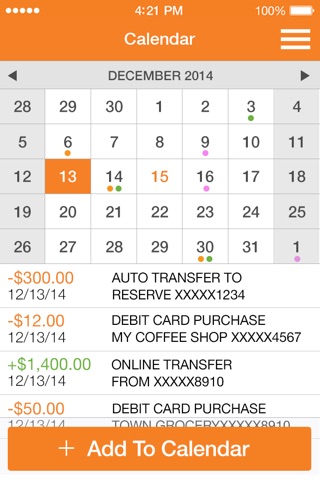

Money Bar and Calendar

Access your Calendar and Money Bar with ease from almost anywhere in the app.

• Use Calendar to see upcoming paydays and payments, and a history of your posted Spend account or included PNC Credit Card transactions. You can pay bills, schedule bill reminders, and view potential Danger Days.

• Use Money Bar to see how much is available to spend with your Free Balance, what you’ve set aside for bills and how much you’re saving in your Reserve goals.

Money Bar® Preview

Turn on Money Bar Preview to get a snapshot of your Free Balance, as well as your Spend, Reserve and Growth balances, without having to sign on.

PNC Easy Lock®

Easily lock or unlock your PNC debit card or credit card.

Punch the Pig®

Make saving fun by tapping or shaking your personalized pig to move money from your Spend to either your Growth or Reserve accounts.

Quick View

Get an overview of your Free Balance, account balances, quick access to your online statements and a list of your recent transactions.

Savings Engine®

Set up automatic savings rules to regularly move money to your Reserve or Growth accounts, like when you receive a paycheck. Create Savings Goals to track your progress toward your goals and move the money to your other accounts.

Spending + Budgets

When transactions post to your Spend account or included PNC Credit Card, you can see where youre spending your money with categories like restaurants, gas and more. Create budgets and set up alerts to know if you’re staying on track.

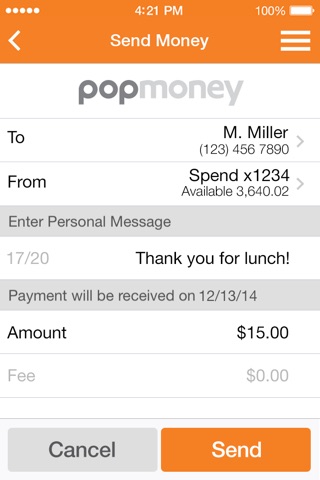

Zelle® (ii)

Send and receive money using your mobile number or email address.

Additional Features

Pay Bills – Use PNC’s convenient bill payment feature to manage all your bills.

Touch ID & Face ID – Sign on to Virtual Wallet with Touch ID or Face ID supported iOS devices.

Password Reset – Reset your PNC Online and Mobile password quickly and conveniently on the app.

Transfer (iii) – Transfer money between your PNC deposit accounts.

Security & Privacy – With PNC’s Security & Privacy, you can be confident that your personal and financial information will be protected while using Virtual Wallet.

PNC Online Banking customers without Virtual Wallet should use the PNC Mobile Banking app.

(i) PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required.

(ii) Zelle should only be used to send or receive money with people you trust. Before using Zelle to send money, you should confirm the recipients email address or U.S. mobile phone number. Neither PNC nor Zelle offer a protection program for authorized payments made with Zelle. Zelle is available to almost anyone with a bank account in the U.S. Transactions typically occur in minutes between enrolled users. If the recipient has not enrolled, the payment will expire after 14 calendar days.

(iii) A federal regulation limits the number of transfers that may be made from a savings or money market account.

Virtual Wallet is a registered trademark of The PNC Financial Services Group, Inc. ©2020 The PNC Financial Services Group, Inc. All rights reserved. PNC Bank, National Association. Member FDIC